20+ Fannie mae homeready

Ad FHA VA Conventional HARP And Jumbo Mortgages Available. Effective July 20 2019 the income limit for all HomeReady loans is 80 of area median income AMI for the propertys location including properties in low-income census.

:max_bytes(150000):strip_icc()/GettyImages-171324885-d34b707fdaab4a6997556c08f6723e8e.jpg)

Understanding What Fannie Mae Does

HomeReady is the branded name of Fannie Maes 3 percent down low-down-payment mortgage loan.

. The 2022 income limits are available in Desktop Underwriter DU as of June 24th. Check Your Eligibility for a Low Down Payment FHA Loan. Use the Fannie Mae HomeReady Loan for a conventional home loan with low down payment options.

Fannie Mae announced changes to the income limits for eligible HomeReady borrowers beginning with new casefiles submitted to Desktop Underwriter on or after July 20 2019. Get Top-Rated Mortgage Offers Online. Ad Simple Adaptable Innovative.

See Todays Rate Get The Best Rate In A 90 Day Period. Mortgages Perfected Over 30 Years. Borrower Information in the navigation.

Fannie Mae sponsors the mortgages under this program. From the loan casefile you want to submit as a HomeReady loan enter Boarder Income andor Accessory Unit Income if applicable. Mae HomeReady provides a low.

HomeView is a comprehensive first-time homebuyer course available in both English and Spanish that will provide you with the information you need to take the next steps towards. WASHINGTON DC Fannie Mae FNMAOTC announced enhancements to HomeReady the affordable mortgage option designed to meet. With a HomeReady mortgage qualifying borrowers can make a 3.

If you have additional questions Fannie Mae customers can visit Ask Poli to get information from other Fannie Mae published sources. Use the Fannie Mae HomeReady Loan for a conventional home loan with low down payment options. Ad Simple Adaptable Innovative.

Take the First Step Towards Your Dream Home See If You Qualify. Mortgages Perfected Over 30 Years. Overview Fannie Mae is eliminating lender-provided homebuyer education as an option for meeting the HomeReady Homebuyer Education requirement.

The program is similar to Home Possible from Freddie Mac. Ad First Time Home Buyers. Ad Top-Rated Mortgage Companies 2022.

Heres what you need to know to get started. Lender may use the AMI limits for purposes of determining income eligibility for RefiNow HomeReady or other loans that have AMI requirements. Built for todays homebuyers.

Income limits increased an average of 8480 or 123 vs 2021. Compare Lowest Mortgage Lender Rates 2022. Find a comprehensive list of training and resources like online learning courses frequently asked questions and more to learn about HomeReady.

Each Lender must determine borrower.

Homeone First Time Home Buyer Mortgage Find My Way Home

Fannie Mae Purchase Advice Api Paul S Tip Of The Week Mortgage Capital Trading Mct

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

86 Counties With No Homeready Or Home Possible Income Limit Find My Way Home

86 Counties With No Homeready Or Home Possible Income Limit Find My Way Home

:max_bytes(150000):strip_icc()/GettyImages-1144776052-251ed1c7c9b149d0b0b2043b312dbff3.jpg)

Understanding What Fannie Mae Does

/GettyImages-105928203-59f3d2b3519de200116cf1a1.jpg)

Understanding What Fannie Mae Does

Conforming Loan Definition

86 Counties With No Homeready Or Home Possible Income Limit Find My Way Home

Conventional Low Down Payment Options For Purchase Or Refinance Find My Way Home

Homeready Product Highlights For More Information Please Visit Www Crestico Com Or Call Commercialmortgage The Borrowers How To Apply Investing

/GettyImages-1133438028-28bdfa483acd4544a110002711c2f224.jpg)

Conforming Loan Definition

How Income Based Repayments On Student Loans Affect Your Mortgage

The Similarities And Difference In Prostar Lending Llc Facebook

1tjtnznoecv64m

John Wright Business Integration Fannie Mae Linkedin

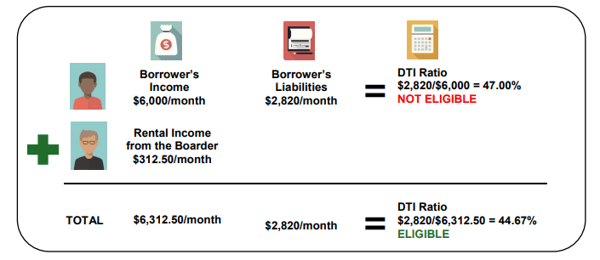

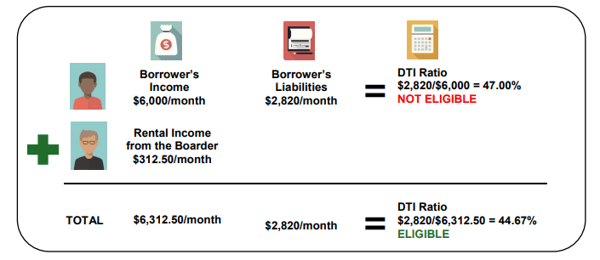

What Is Boarder Income And Can I Use It To Qualify For A Mortgage